大多数美国人相信他们将在2030年实现他们的财务目标

大多数美国人相信他们将在2030年实现他们的财务目标

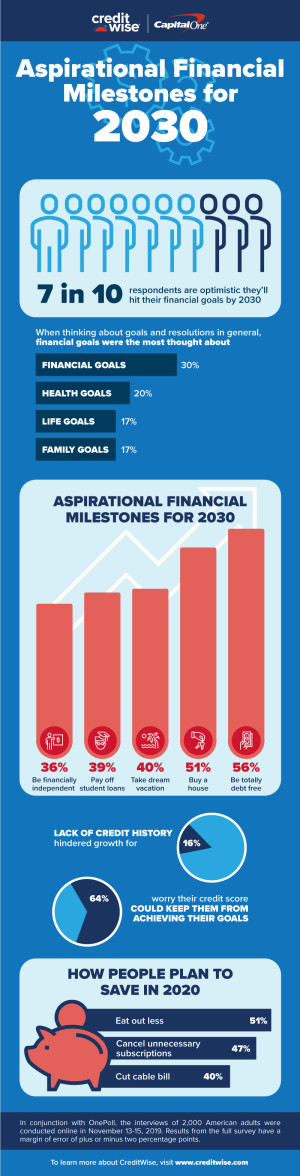

A new decade is a time for new resolutions and seven in 10 Americans are optimistic they’ll achieve their financial goals by 2030, according to a new survey.

一项最新调查显示,新十年是制定新计划的时候,70%的美国人对2030年实现财务目标持乐观态度。

From buying a house (51 percent) to going debt-free (56 percent), people are thinking ahead and want to use the new year to start planning their financial future.

从买房(51%)到无债务(56%),人们都想在新的一年开始规划自己的财务未来。

Other major milestone goals for the new decade included taking a dream vacation (40 percent), getting married (38 percent) and becoming financially independent (36 percent).

新十年的其他主要里程碑目标包括:梦想之旅(40%)、结婚(38%)和经济独立(36%)。

The survey of 2,000 Americans examined the resolutions and expectations people have when it comes to their wallets. Many are taking it seriously, as 44 percent already have a specific goal in mind for 2020.

这项共有2000名美国人参加的调查主要考察了人们在花钱方面的决心和期望。许多人都很认真,因为44%的人已经有了2020年的具体目标。

Conducted by OnePoll and commissioned by CreditWise from Capital One, the survey found things are looking up for 2020 since three in five (63 percent) are “very confident” they’ll make their New Year’s financial resolutions a reality.

这项由OnePoll和CreditWise委托Capital One进行的调查发现,2020年的情况正在好转,因为五分之三(63%)的受访者“非常有信心”实现自己的新年财务计划。

It might take some creative methods to pinch pennies, but respondents are up to the task. Half of those with a 2020 monetary resolution plan (51 percent) will be putting more money from their paycheck straight to savings and cutting back on eating out (51 percent).

可能需要一些创造性的方法来节省开支,但受访者能够胜任这项任务。在制定了2020年货币解决计划的人中,有一半(51%)将直接从工资中拿出更多的钱存起来,并减少外出就餐的次数(51%)。

With the streaming wars in full force, four in 10 with a New Year’s financial resolution will be cutting their cable bill, while 47 percent will be canceling unnecessary subscription services that can add up to a pretty penny.

随着流媒体大战的全面展开,每10个有新年财务计划的人中就有4个会削减有线电视的费用,而47%的人会取消不必要的订阅服务,而这些订阅服务加起来可以省下一大笔钱。

Buying expensive lunches can put a dent in savings — one in five say a New Year monetary goal will be brown-bagging lunches in 2020.

购买昂贵的午餐可能会减少储蓄——五分之一的人表示,2020年的新年货币目标将是自带午餐。

“Good credit can go a long way in helping consumers achieve their financial goals,” said Chris Gatz, head of CreditWise at Capital One. “The key is making healthy credit behaviors part of your routine year-round. There are many tools out there, like CreditWise, a free credit monitoring tool that helps people understand, improve and monitor their credit and is available for free to everyone-Capital One customer or not.”

“良好的信用对帮助消费者实现他们的财务目标大有帮助,”Capital One的CreditWise主管克里斯•加茨(Chris Gatz)表示。“关键是让健康的信贷行为成为你全年的日常生活的一部分。现在有很多工具,比如CreditWise,这是一个免费的信用监控工具,可以帮助人们了解、改善和监控自己的信用,而且对所有人都是免费的——不管是不是capital One的客户。”

Respondents are hoping little tweaks will have big payoffs someday, but that doesn’t mean a little — or big — help wouldn’t be nice.

受访者希望小小的调整有一天能带来大的回报,但这并不意味着一点点或很大的帮助就不好了。

Twenty-two percent of respondents admitted that they would need an outright miracle to help meet their dream financial milestones.

22%的受访者承认,他们需要一个彻底的奇迹来帮助他们实现梦想中的财务里程碑。

But more realistically, Americans say gunning for higher salary (40 percent), meeting with financial advisors (26 percent) and paying off all loans (47 percent) would be helpful.

但更现实的情况是,美国人说争取更高的薪水(40%)、与财务顾问会面(26%)和还清所有贷款(47%)会有帮助。

Twenty-nine percent of respondents admitted what they would really need to make those dreams come true was more self-control.

29%的受访者承认,要实现这些梦想,他们真正需要的是更多的自我控制。

That might be why one in four (26 percent) would rather get a cavity filled than make a budget for 2020.

这可能就是为什么四分之一(26%)的人宁愿去补牙也不愿做2020年的预算。

Respondents blamed a variety of factors for their negative financial impacts with number one being medical expenses (46 percent).

受访者认为造成负面经济影响的原因有很多,其中首当其冲的是医疗费用(46%)。

Periods of unemployment (35 percent) obviously prompted more spending than saving. Common, but necessary expenses like car repairs (19 percent) and family emergencies (22 percent) certainly didn’t help either.

失业时期(35%)明显刺激了更多的消费而不是储蓄。汽车维修(19%)和家庭紧急情况(22%)等常见但必要的费用当然也没有帮助。

Additionally, 16 percent admitted a lack of credit history hindered their financial growth. Sixty-four percent revealed they’re worried their credit score could prevent them from achieving their milestone financial goals.

此外,16%的人承认缺乏信用记录阻碍了他们的财务增长。64%的人表示,他们担心自己的信用评分可能会妨碍自己实现重要的财务目标。